The OBBB may disqualify hundreds of hospitals from the 340B program

Medicaid cuts could drop many hospitals below the required DSH thresholds

This post is a follow-up on a longer post about the 340B Drug Pricing Program. See that post for more background on the program, including what it is, how it works, and some of its issues.

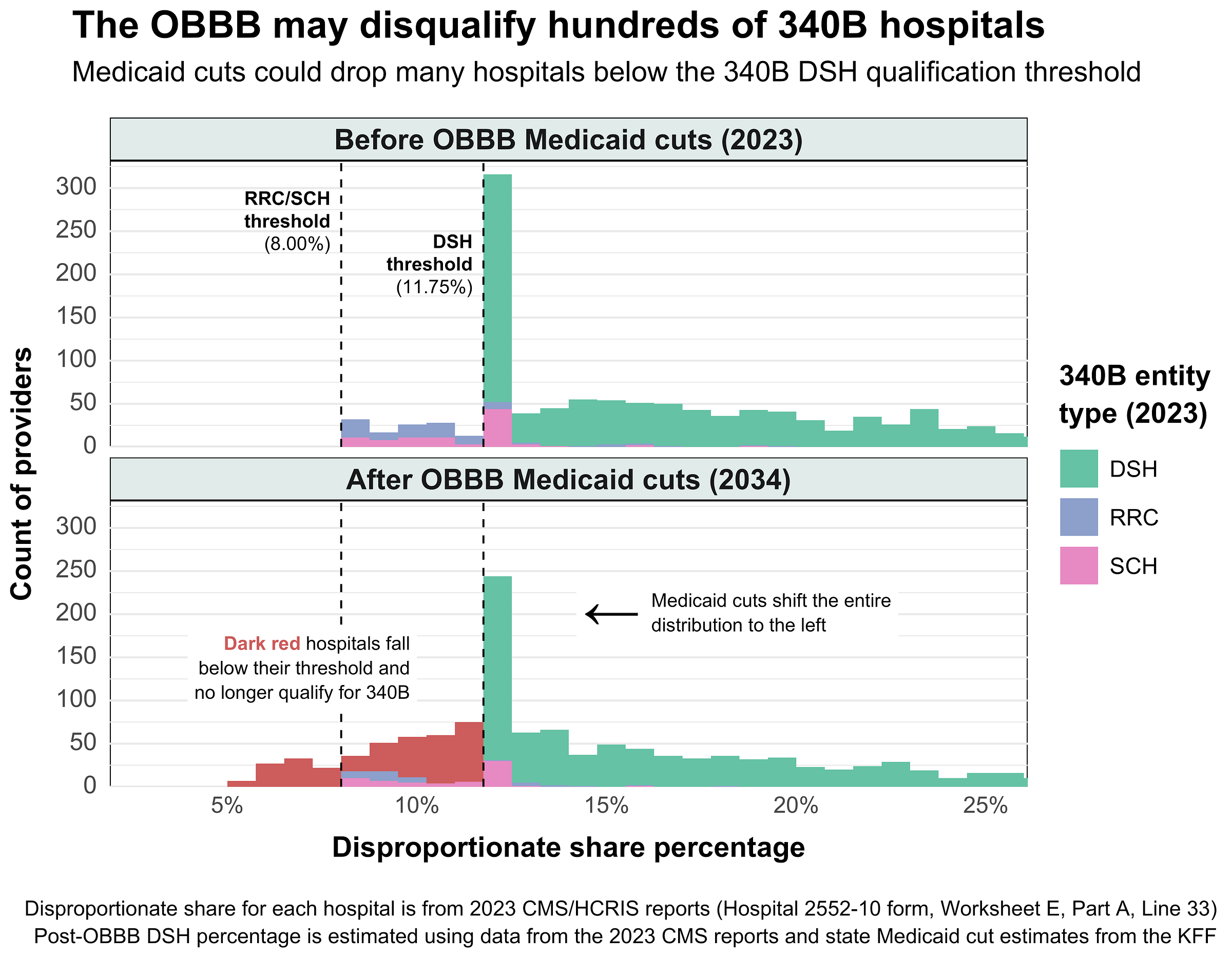

The One Big Beautiful Bill (OBBB) Act may disqualify over 300 hospitals from the 340B program – about 12% of the ~2,500 providers currently enrolled. Disqualified hospitals would lose access to 340B’s discounted drug prices, which would severely impact their financial health and possibly even force some to close.

The disqualifications stem from the OBBB’s effect on hospitals’ Disproportionate Share Adjustment percent (DSH %), a key metric used to determine 340B eligibility. DSH percent is derived from the Disproportionate Share Patient Percent (DPP), which quantifies the proportion of low-income Medicare and Medicaid patients a hospital serves:

Holding all else constant, the OBBB’s substantial Medicaid spending cuts will lower the number of Medicaid patient days (bolded) in the DPP formula above. As a result, DPP (and therefore DSH percent) will decrease, shifting many providers below the thresholds required by 340B:

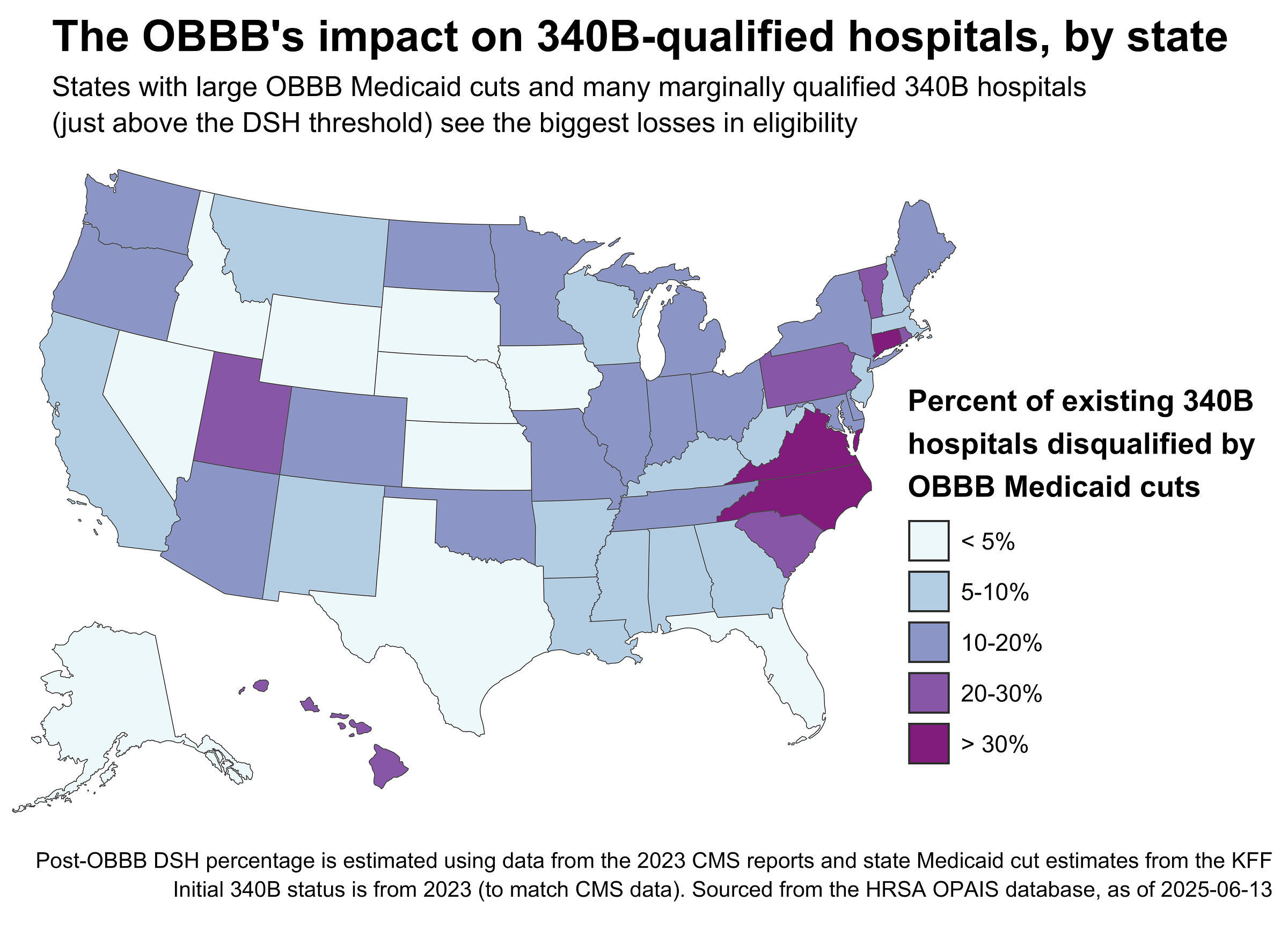

Using state-level estimates of the OBBB’s impact on Medicaid spending, I recalculated the DSH percent of each 340B hospital based on 2023 CMS cost reports. In a worst-case scenario, 314 hospitals would lose 340B eligibility due to the OBBB cuts. This assumes that hospitals do nothing and simply allow their DSH percentages to drift downward. Here’s what the fallout looks like by state:

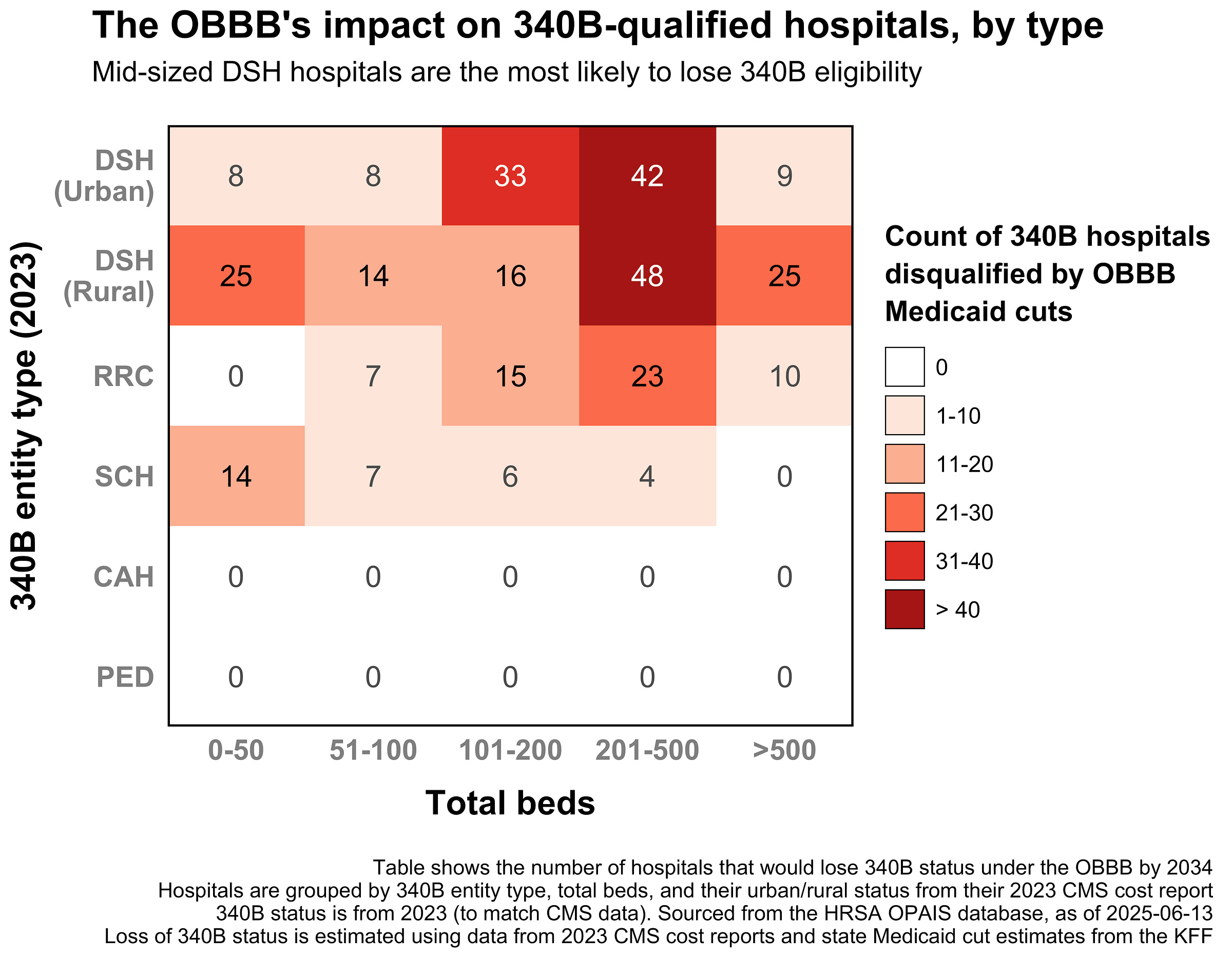

And by hospital type:

To summarize, the OBBB mainly impacts the 340B eligibility of hospitals that are:

In states with substantial OBBB Medicaid spending cuts (see the KFF map)

Right above the 340B DSH threshold relevant to their covered entity type

Serving a large number of Medicaid patients specifically impacted by work requirements

Rural or mid-sized urban DSH hospitals (using the CMS definition of rurality)

In short, the OBBB is likely to impact already-vulnerable safety-net hospitals the most, cutting their Medicaid revenue and removing the cushion of 340B savings in one blow. That double hit could leave many rural and mid-sized urban providers underwater, undoing the very support the 340B program was meant to provide.

Notes

Some notes and assumptions about this analysis:

For a full list of affected 340B hospitals, including their current and counterfactual DSH percent, see the CSV here.

This analysis assumes that percent cuts in Medicaid spending translate to equivalent percent cuts in patient days. This is imperfect, but a good-enough proxy until all state-level estimates of the OBBB’s effects on Medicaid enrollment become available.

This analysis assumes ceteris paribus, i.e. all other factors affecting DSH percent are held constant over time. This isn’t likely to hold, as historically hospitals are fairly scrappy and will probably find a way to move their DSH percent if needed.

How quickly Medicaid enrollment decreases will affect DSH percentages is a bit ambiguous. States must implement the OBBB’s work requirements by December 2026, but stringency and implementation speed will likely vary significantly by state.

Critical Access Hospitals aren’t affected since they don’t have a DSH percent requirement.

The code needed to replicate this analysis is available on GitHub. See this PR for the relevant bits.